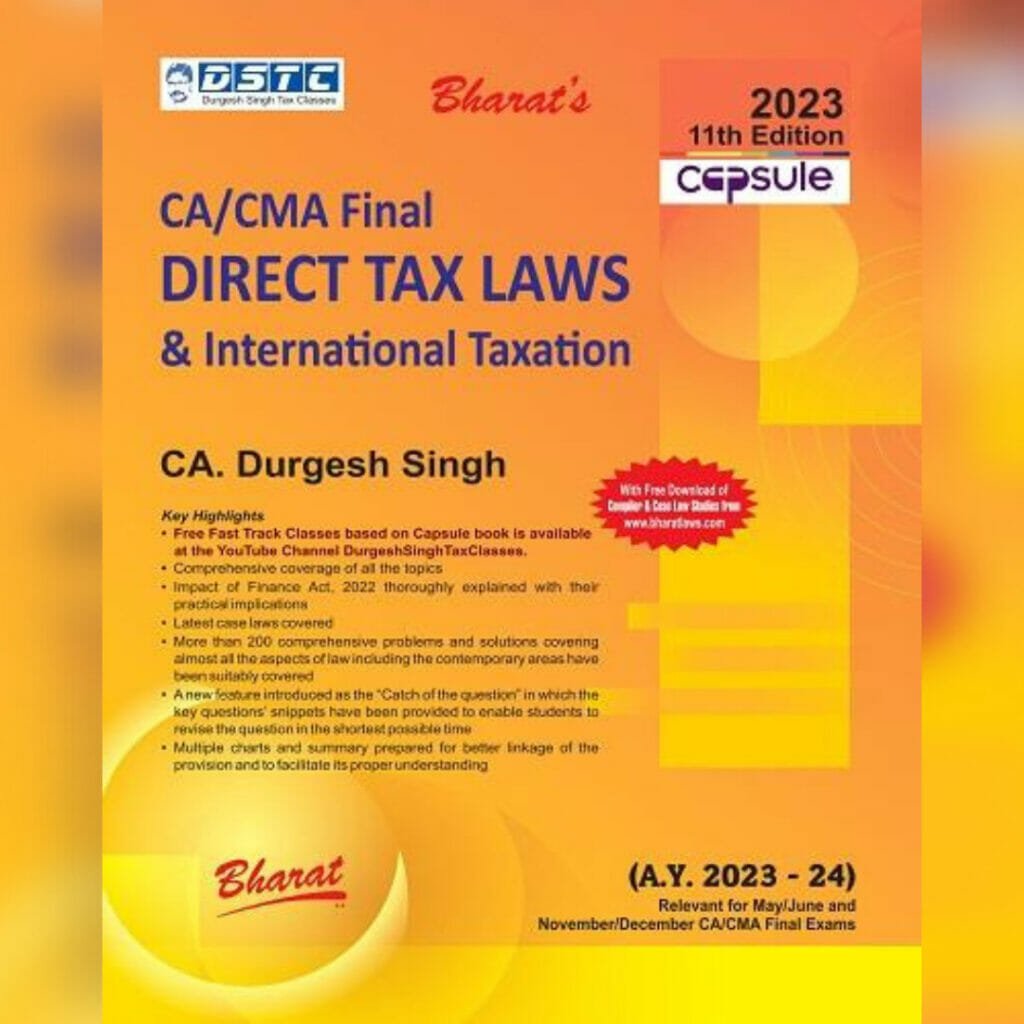

| FACULTY NAME | CA DURGESH SINGH |

| BINDING | PAPERBACK |

| ATTEMPT APPLICABLE | MAY 2023, NOV 2023 & ONWARD |

| IMPORTANT NOTE | DISPATCH OF THESE BOOKS STARTS FROM FEBRUARY FIRST WEEK |

| PUBLICATION DATE | 2022 |

| MATERIAL FORMAT | BOOKS IN HARD COPY |

| BOOK LANGUAGE | ENGLISH |

| TOPICS COVERED | CLICK THE BOOK CONTENTS TAB TO READ TOPICS COVERED IN THE BOOK |

| DISPATCH TIME | WITHIN 2 WORKING DAYS |

| DELIVERY TIME | WITHIN 3-4 WORKING DAYS |

CA FINAL DIRECT TAX LAWS & INTERNATIONAL TAXATION CAPSULE STUDIES BOOKS BY CA DURGESH SINGH

₹1,750 ₹1,400

Enjoy Privileges Like

- Free Shipping

- Refer & Earn

- No Hassle Refunds

Book Contents

Key Highlights

• Free Fast Track Classes based on Capsule book is available at the YouTube Channel DurgeshSinghTaxClasses.

• Comprehensive coverage of all the topics

• Impact of Finance Act, 2022 thoroughly explained with their practical implications

• Latest case laws covered

• More than 200 comprehensive problems and solutions covering almost all the aspects of law including the contemporary areas have been suitably covered

• A new feature introduced as the “Catch of the question” in which the key questions’ snippets have been provided to enable students to revise the question in the shortest possible time.

• Multiple charts and summary prepared for better linkage of the provision and to facilitate its proper understanding

Coverage of the book

The book comprehensively covers:

• The entire syllabus of direct tax in simplified and lucid manner.

• More than 500 comprehensive problems and solutions covering almost all the aspects of law including the contemporary areas have been suitably covered in the ‘Compiler’ in pdf form to provide the students adequate practice of the subject.

• A new feature introduced as the “Catch of the question” in which the key questions’ snippets have been provided to enable students to revise the question in the shortest possible time.

• All the recent amendments are separately highlighted

• All amendments and notifications applicable for May & November, 2023. CA Final attempt have been covered suitably both in its theoretical understandings as well as its practical implications.

• Case laws which are likely for the upcoming exams have been covered in a summarised manner to facilitate the students to remember the key point and principles arising in the judgment.

• New topics for new course have been covered separately and comprehensively

Detailed Contents –

Taxation of Unit Linked Insurance Plan – FA 2022

1. Income Tax Rates

2. Income from Salaries

3. Income from House Properties

4. Profits and Gains from Business Or Profession

5. Business Deductions under Chapter VIA & 10AA

6. Income Computation and Disclosure Standards (ICDS)

7. Alternate Minimum Tax

8. Assessment of Partnership Firms

9. Chapter VI-A Deductions

10. Capital Gains

11. Income from Other Sources

12. Set Off and Carry Forward of Losses

13. Clubbing Provisions

14. Assessment Procedure

15. Rectification, Appeal & Revision

16. Recovery Proceedings

17. Authority of Advance Ruling and Dispute Resolution

18. Penalties and Prosecution

19. Refund Provisions

20. Special Tax Rates for Companies

21. Alternative Tax Regime

22. Co-operative Society and Producer Companies

23. Taxation of Dividend

24. Surrogate Taxation

25. Trust Taxation

26. Hindu Undivided Family

27. Association of Person (AOP) & Body of Individual (BOI)

28. Liabilities In Special Cases

29. Tax Deducted at Source

30. Tax Collected at Source

31. Advance Tax & Interest

32. Non Resident Taxation

33. Taxation of NR Sportsman

34. Double Taxation Relief

35. Miscellaneous Provisions

36. Equalization Levy

37. Transfer Pricing

38. Concepts & Principles of Interpretation of Double Taxation Avoidance Agreements (DTAAS)/Tax Treaties

39. Miscellaneous Provisions of International Taxation

40. General Anti-Avoidance Rules (GAAR)

41. Appendices

42. Case Laws – Charts

About CA Durgesh Singh :-

CA. Durgesh Singh has overall 14 years teaching experience at CA Final in Direct & Indirect Taxes. He is immensely popular with students for his teaching ski lls on the subject. With a big four background, he is currently a Partner in a large CA Firm with an expertise in Corporate, International and Indirect Taxation matters. He believes in the mantra that ?if you know why, you know how?. He is known for conceptual teaching along with problem solving in class for better presentation of answers in exams. At the same time he summarises the entire subject through charts for last day revision and preparing for the exam day through mock tests. His students have been All India Rank holders and best paper awardees in Direct and Indirect Taxes. His students are preferred in Big Four as his teaching is more contemporary, suited to the present dynamic scenario. He is the only faculty in India of repute to teach Direct as well as Indirect Taxation at CA Final & I PCC level

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.