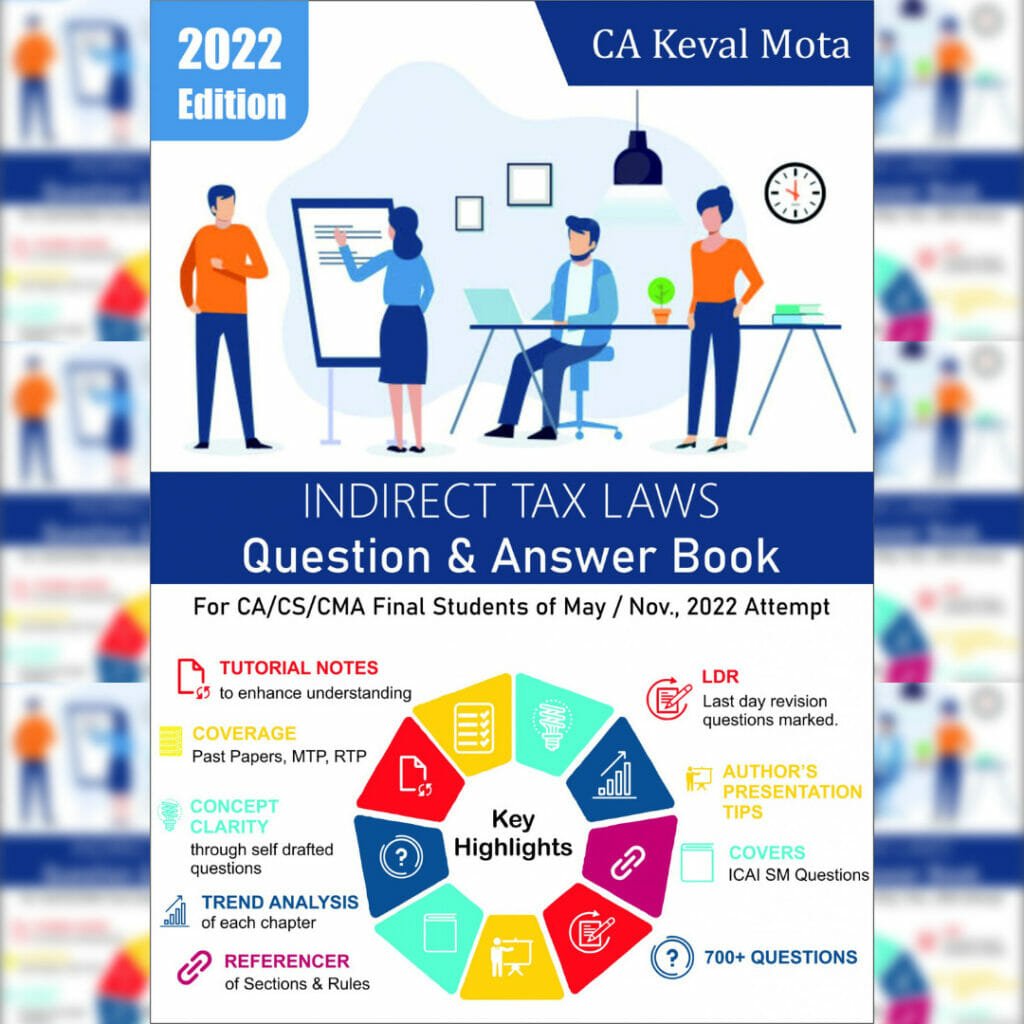

| FACULTY NAME | CA KEVAL MOTA |

| APPLICABLE COURSE | NEW SYLLABUS |

| ATTEMPT APPLICABLE | MAY 2023, NOV 2023 & ONWARD |

| PUBLICATION DATE | JANUARY 2022 |

| DEMO CHAPTERS | REFUND UNDER GST |

| MATERIAL FORMAT | BOOKS IN HARD COPY |

| BOOK LANGUAGE | ENGLISH |

| DISPATCH TIME | WITHIN 2 WORKING DAYS |

| DELIVERY TIME | WITHIN 4-8 WORKING DAYS |

| DISPATCH BY | CONCERN INSTITUTE |

CA FINAL INDIRECT TAX – QUESTION & ANSWER BOOK BY CA KEVAL MOTA

₹699

CA Keval Mota IDT Question Answer Book

Out of stock

Categories: Books, CA Final Books, Indirect Tax Laws

Tag: Final IDT Question Bank

Enjoy Privileges Like

- Free Shipping

- Refer & Earn

- No Hassle Refunds

More Info

Salient Features of Question Answer Book –

- Last Day Revision Questions marked in book itself.

- Concepts wise arranged Questions

- Updated with Amended Law for May/ Nov 2022 exams

- Covers all Past Attempt Question Papers, MTP, RTP etc.

- Self-Drafted Questions for better understanding of Concepts.

- Trend Analysis of Each Chapter (at beginning)

- Section & Rule Referencer

- Tutorial Notes for Lengthy & Tricky Questions

- Authors Presentation Tips.

- More than 700+ questions.

About Author –

CA. Keval Mota is a member of the Institute of Chartered Accountants of India (ICAI) based out of Mumbai, India. He is a GST enthusiast and an excellent orator. He has vast experience in teaching Indirect Taxes to the Students of the Institute of Chartered Accountants of India, the Institute of Cost Accountants of India, and the Institute of Company Secretaries of India. In his career, he has addressed various seminars for corporate entities and has independently carried out SAP implementation and 1m pact Analysis for large corporations during the inception of GST Law in the Indian economy. Due to his forte in Indirect Taxation, he has also worked for International indirect Tax Implementation on UAE VAT at Dubai & Abu Dhabi in January, 2018. He is a regular contributor of insightful articles on professional website “TaxGuru.in0 and has good number of published articles to his credit. He has summarised entire GST & Customs in 50 pages containing in-depth analysis of relevant provisions and interlinking of all provisions under GST and Customs Law. He can be reached at “kevaLmota4gmait.com”

Only logged in customers who have purchased this product may leave a review.

Related products

- Books

₹1,999Original price was: ₹1,999.₹1,200Current price is: ₹1,200.CA FINAL NEW SYLLABUS FINANCIAL REPORTING “FR BRAHMASHTRA SET OF 2 VOLUME” BY CA SARTHAK JAIN

- Books

₹550Original price was: ₹550.₹440Current price is: ₹440.CA / CMA FINAL NEW SYLLABUS DIRECT TAX COMPILER BOOK BY CA BHANWAR BORANA

- Books

₹599Original price was: ₹599.₹539Current price is: ₹539.CA FINAL NEW SYLLABUS IDT QUESTION BANK AND MCQS BOOK BY CA YASHVANT MANGAL

Reviews

There are no reviews yet.