More Info

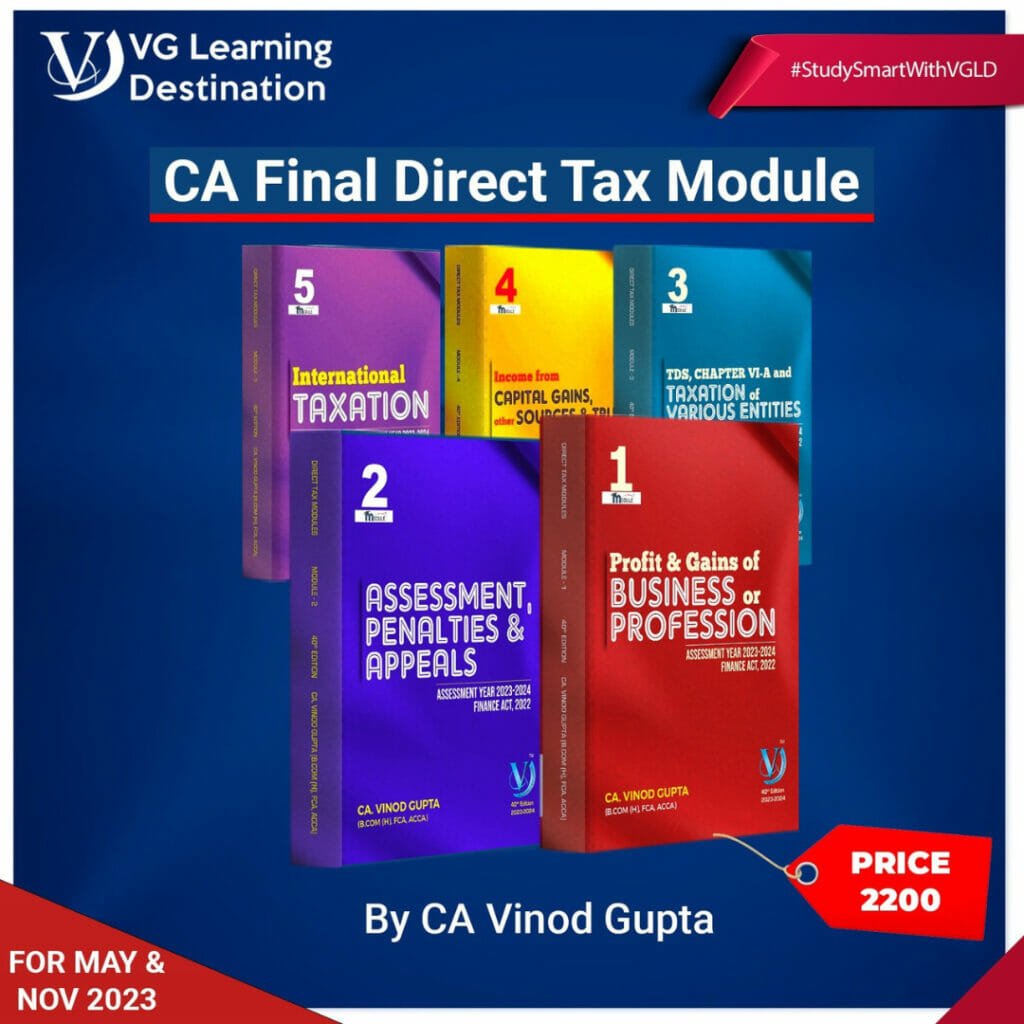

CA Final Direct Taxes Modules By Vinod Gupta Finance Act 2022

Direct Taxes CA Final Modules Vinod Gupta Finance Act 2022

Set of 5 modules Summary Module not included

Description

In early 1990, after teaching the students of chartered accountancy for four years, I was motivated to compile my study material and give it the shape of a book. Since then the idea of “Modules” was evolved. This idea was turned into reality in 1992 when I released the first edition of Modules. My journey with the coaching and modules still continued and it gives me immense happiness to release 40th Edition of Direct Tax Modules which present law as applicable for the assessment year 2023-24 with all the latest updates incorporated in it. Latest in judiciary, circulars, notifications, press releases etc. have also been incorporated and analysed. The emphasis of Direct Taxes Modules is to simplify an otherwise complex subject in reader friendly manner. Conscious efforts have been made to keep the language of the Modules simple and crisp. The text is supported by examples & practicals to illustrate the real time application of the subject. The past examination questions section contains the problems of the last 50 exams of final level of CA course. Solutions thereof as updated according to the current applicable law will help student to maintain a meaningful focus on examination requirements while studying the subject.

This package includes a set of 5 Modules.

– These Modules are applicable for May 2023 & November 2023 Attempts.

– Module 1 will dispatch from 10th November 2022

– Rest modules will dispatch as soon they are available

– AMENDED BY FINANCE ACT, 2022 l ASSESSMENT YEAR 2023-2024

Assessment Year 2023-24 Relevant for May 2023 / November 2023 Examinations A set of 5 Modules especially designed to cater the needs of C.A. (Final) Students

- Profits & Gains of Business or Profession – Available

- TDS,Chapter VI-A and Taxation of Various Entities – Available on 30th November 2022

- Assessments Penalties & Appeals – Available on 30th November 2022

- Income From Capital Gains & Other Sources –Available on 30th December 2022

- International taxation –Available on 30th December 2022

About The Author

CA Vinod Gupta : CA Vinod Gupta qualified CA with rank in C.A. Intermediate and C.A.Final examination in 1986. He has been awarded for the best paper on, Taxation in C.A. Final Examination. He has authored around 100 articles, on taxation in various journals and newspapers including Taxman, Current, Tax Reporter, Chartered Accountant, Economic Times and Financial Express. He is currently teaching CA Final students in Northern India.CA Vinod Gupta is having vast experience of teaching Direct tax, faculty at New Delhi for last 18 years

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.